25+ hecm vs reverse mortgage

Get Free Info Now. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Is This A Good Time To Get A Reverse Mortgage Next Avenue

Learn About This Mainstream Movement.

. Learn Why Retirees Trust Longbridge. Web A home equity conversion mortgage HECM is a federally insured reverse mortgage that allows you to receive a cash payment from your home equity every. Web A home equity conversion mortgage HECM is insured by FHA that allows those age 62 and older to tap into a portion of their equity.

Ad Expand Your Purchasing Power with a Reverse Mortgage. Web HECM reverse mortgages can help homeowners who cant qualify for cheaper financing like home equity loans because of credit problems or insufficient. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

We Are Not A Loan Company We Do Not Lend Money. Web HECMs are reverse mortgages backed by the federal government and issued by an FHA-approved lender. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

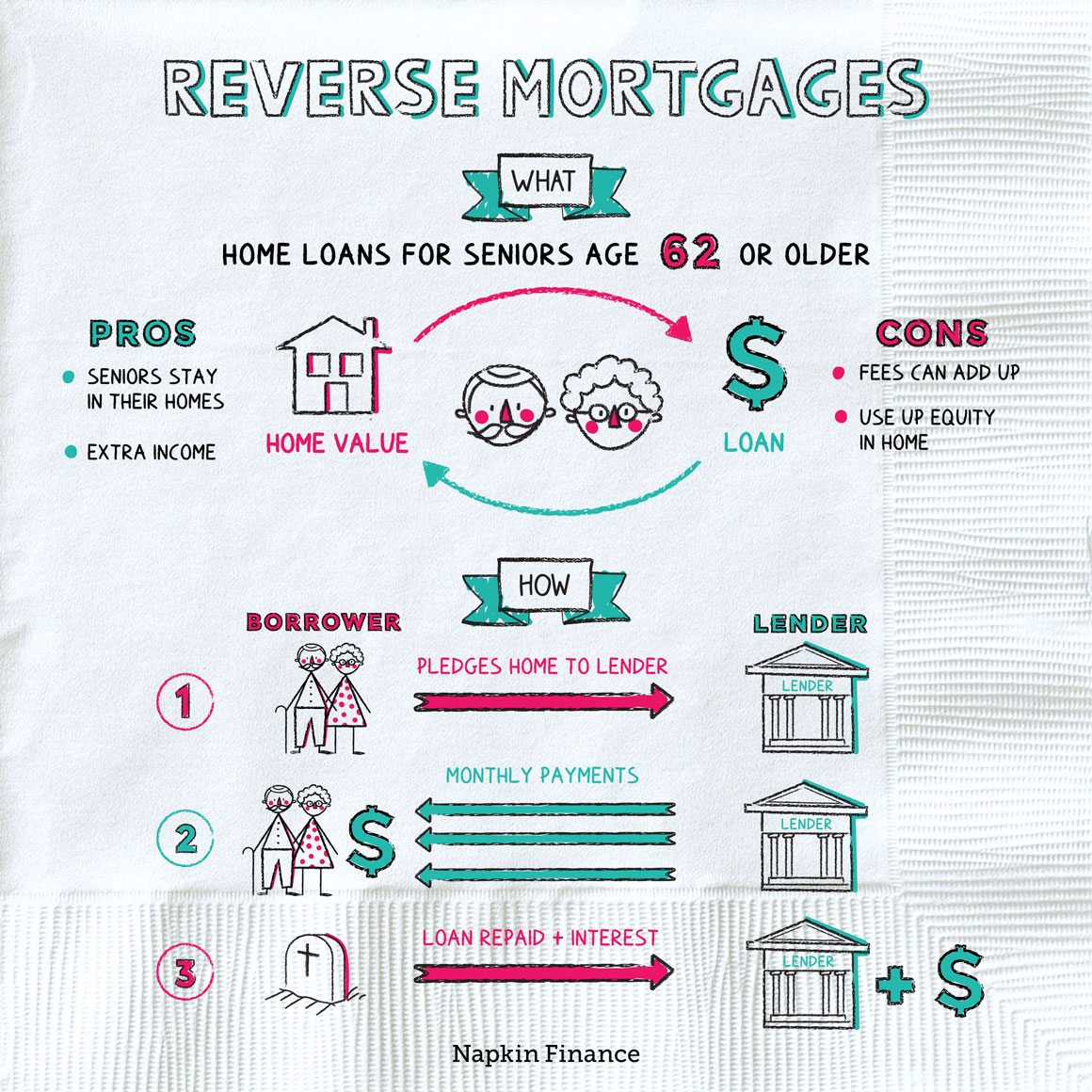

Web A reverse mortgage is a loan uniquely created for homeowners aged 62 and above. Ad Reverse Mortgage Counseling Sessions Offered By HUD-Approved Agency. To find a reverse mortgage counselor that provides telephone and face.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. President Ronald Reagan signed the law in. Web The HECM is a reverse mortgage loan insured by the Federal Housing Administration FHA for borrowers at least 62 years old.

Web The most common type of reverse mortgage is a Home Equity Conversion Mortgage or HECM. Ad Compare the Best Reverse Mortgage Lenders In The Nation. Ad Expand Your Purchasing Power with a Reverse Mortgage.

Web To find a reverse mortgage counselor near you search the HECM Counselor Roster or call 800 569-4287. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad Reverse Mortgages Have Helped Thousands of Retirees.

Reverse Mortgages Are More Common Than You Think. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Most reverse mortgage loans today are Home Equity Conversion Mortgages HECMs insured by the Federal Housing Administration FHA which is a part of the.

Web Home Equity Conversion Mortgage HECM is the only type of reverse mortgage that is federally insured. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. Free 1-On-1 Sessions w Mortgage Experts.

This type of reverse mortgage is designed for homeowners who. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. These loans are only available through an FHA.

Web A Home Equity Conversion Mortgage HECM the most common type of reverse mortgage is a special type of home loan only for homeowners who are 62 and. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Typically non-HECMs reverse mortgages may have higher interest.

Also called a Home Equity Conversion Mortgage HECM this loan program has been.

Hecm For Purchase Buy Your Next Home Without A Mortgage Payment

Reverse Mortgage Loans Consumer Financial Protection Bureau

Pros Cons Of The Hecm Credit Line Senior Lending

The Reverse Mortgage Refi Boom Is Over Nmp

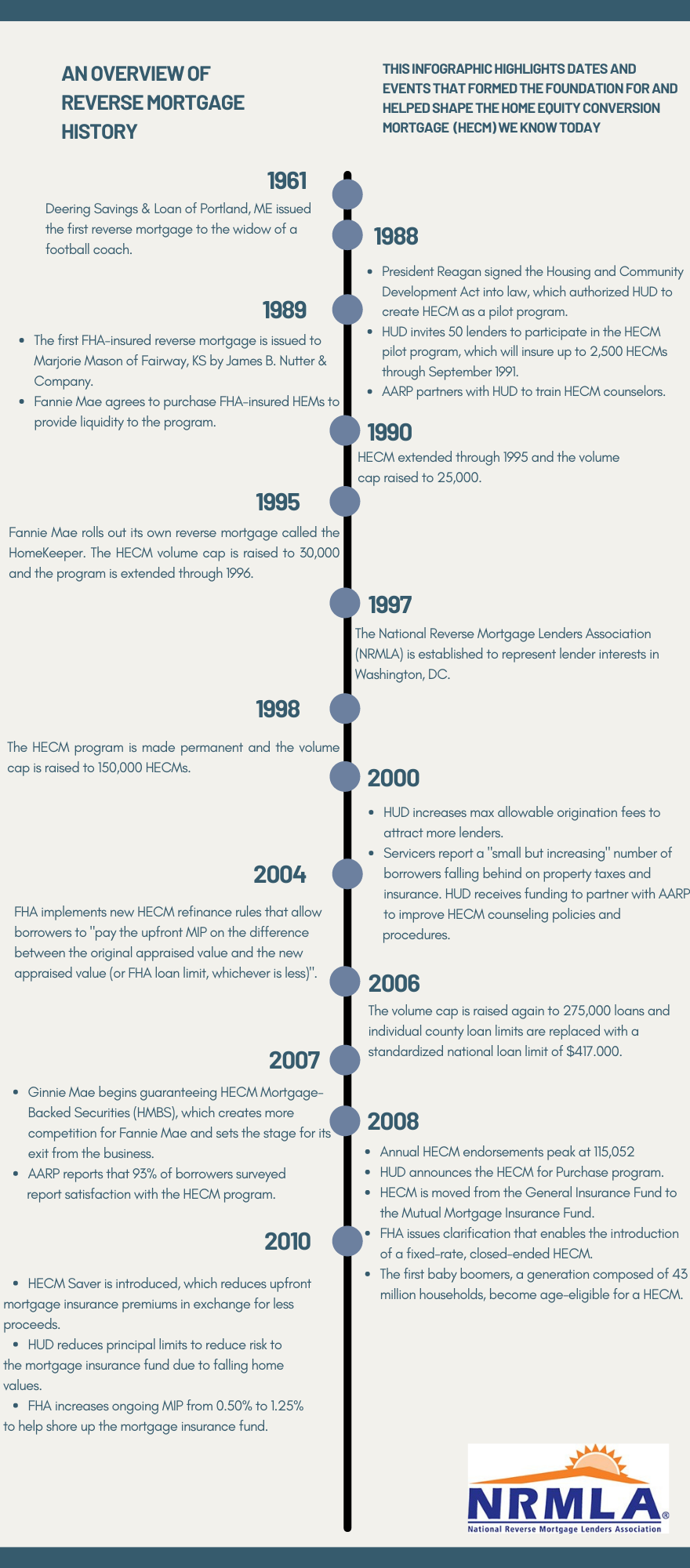

An Overview Of Reverse Mortgage History Nrmla

What To Expect During Reverse Mortgage Counseling

Kalkulation Von Lifetime Bzw Reverse Mortgages Eine Kritische Analyse Am Beispiel Des Us Amerikanischen Home Equity Conversion Mortgage Hecm Modells Springerlink

Alternative Modelle Zu Reverse Mortgage Zur Altersvorsorge

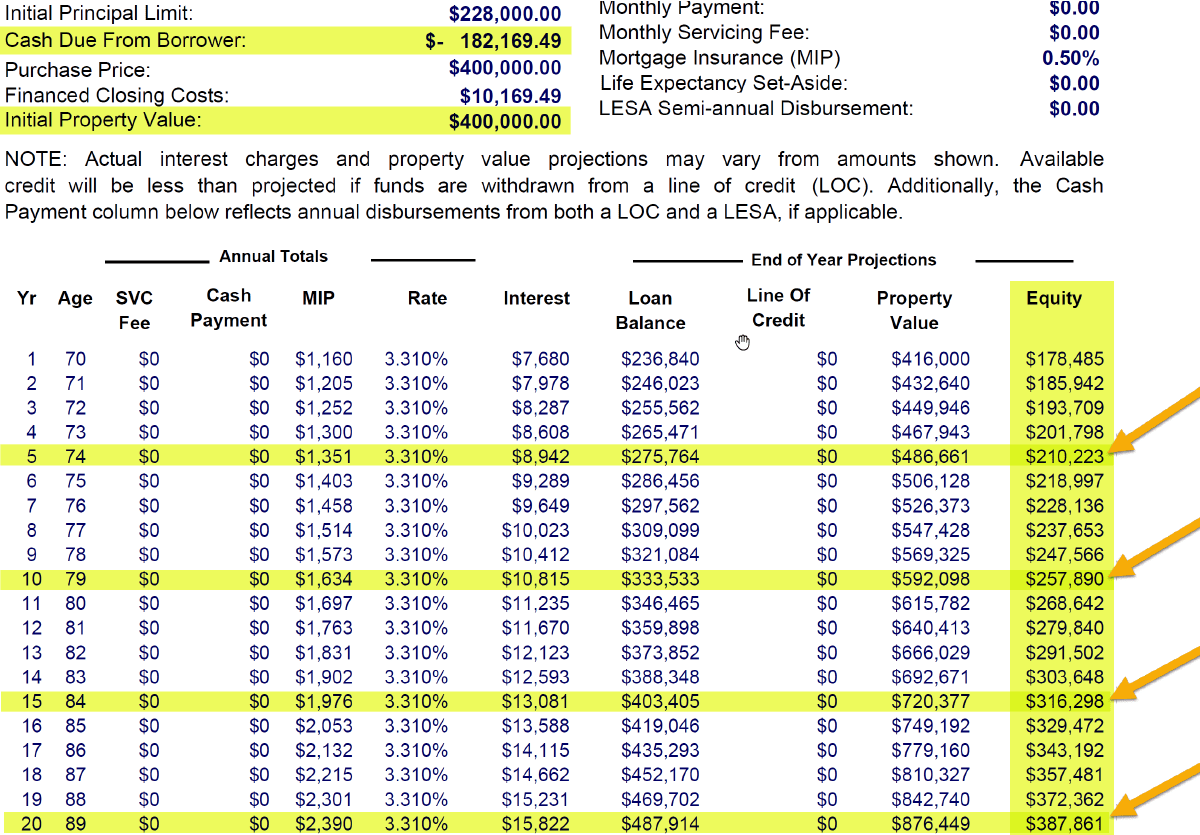

Hecm Vs Heloc Loan Comparison Which Is Best For You Reversemortgagereviews Org

Busting Three Half Truths About Reverse Mortgages

Reverse Mortgage Purchase Down Payment Rates Eligibility

Reverse Mortgage Pros And Cons For Homeowners

What Is A Reverse Mortgage Requirements Pros And Cons Intuit Mint

What Is Reverse Mortgage Loan Learn Reverse Mortgage Definition Here

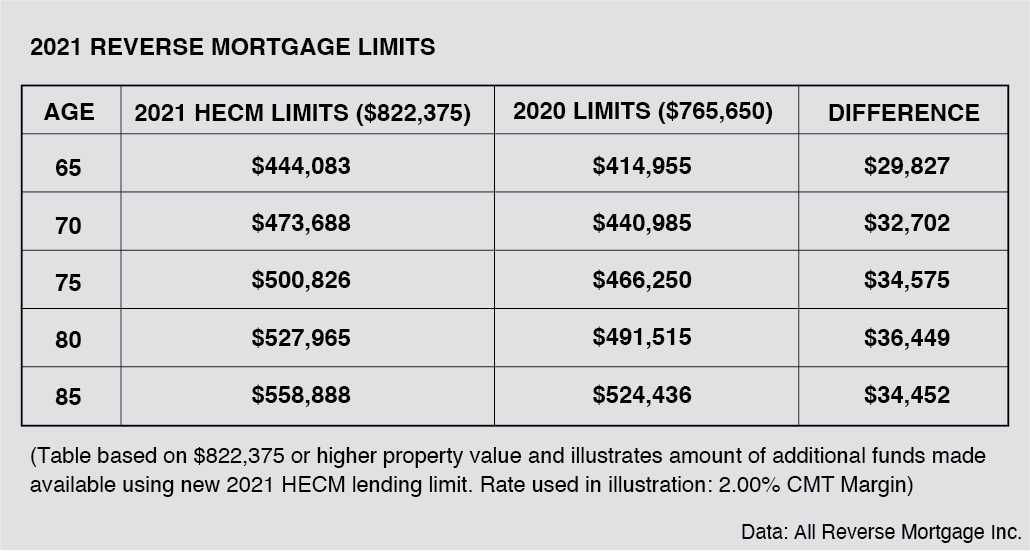

October 2 2017 Changes To The Hecm Reverse Mortgage

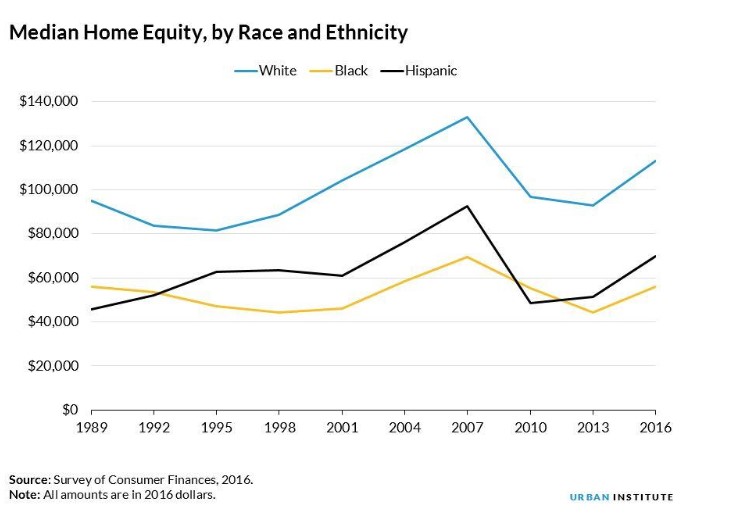

Urban Institute Reverse Mortgage Use Differs By Race And Ethnicity Nrmla

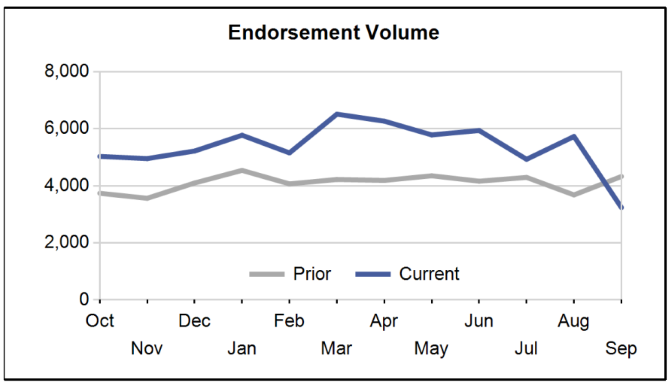

Reverse Mortgage Volume Is Declining